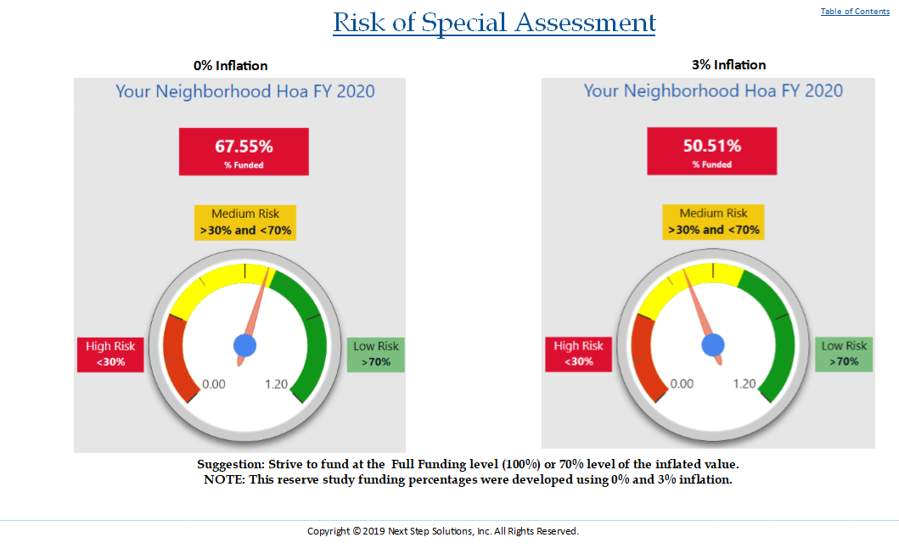

The Next Step Solutions Reserve Study has two special assessment gauges to indicate the reserve funding percentage under each scenario and a rating guide to indicate low, medium, and high risk. One gauge provides reserve funding at 0% inflation. One gauge at the boards chosen inflation rate.

The reserve study completed at 0% inflation provides a 67.55% funding level, which puts it in the Medium Risk category. As indicated, medium risk is between 30% and 70% funding.

The second reserve study is completed at a board chosen inflation rate. In this example, 3% was used. This means that if the HOA added 3% inflation to the capital items in the reserve study, that would provide a funding level of 50.51%, about in the middle of the medium risk category.

The danger in only using 0% inflation is the fact that all

goods and serves increase annually by the rate of inflation. Have you ever seen

prices go down? No. So, what is the solution? Prudent board members should

strive to achieve a 100% funding level at 0% inflation to ensure inflation is

factored int o reserve savings. In this example, the board should raise the

reserve funding level to get the percent funded level closer to 100% at 0%

inflation.